Planned disruptions and over-capacity sway FTL rates

The TL market is always changing because of many different factors. In the second quarter of 2024, two main things affected the rates: normal seasonal disruptions and over-capacity of trucks. Let’s see what these events were and how they impacted the market. We’ll also look at what else to watch for.

How seasonal disruptions affected truckload rates

Some normal seasonal events that happen every year can affect TL rates. For example, International Road Check, produce season and the Memorial Day holiday may have influenced TL rates. But rates are starting to show that the overall market is returning to a more normalized seasonal pattern.

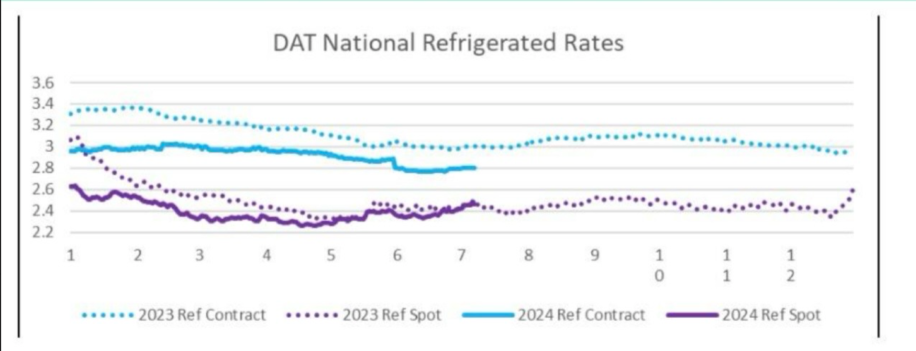

Produce season usually means higher reefer rates because there is more demand for them, and this year was no different, with spot rates going up 3.5% from May 1 to June 1. Contract rates for refrigerated shipping continued to reset lower. They fell 2% in April, 4.4% in May, and 6.1% year to date. Compared to last year, contract reefer rates were down 7.3%.

Source: DAT National Reefer Rates

Dry van rates fell 3% the first 39 days of 2Q before rising 6.2% in the second half of the quarter. Overall, spot rates are slightly higher than 2023 van rates as this rally continues into 3Q. This means spot van rates were down historically but started rising through the end of the quarter. Spot van rates are now up 7.2% from their low spot in May. Contract rates for dry vans, however, did not see this same rate increase and were down 3.2% for the year, reaching a new dataset low of $2.39/mile on June 4. Overall, contract rates for dry vans were down 8.1% year over year.

Overcapacity in the market continued

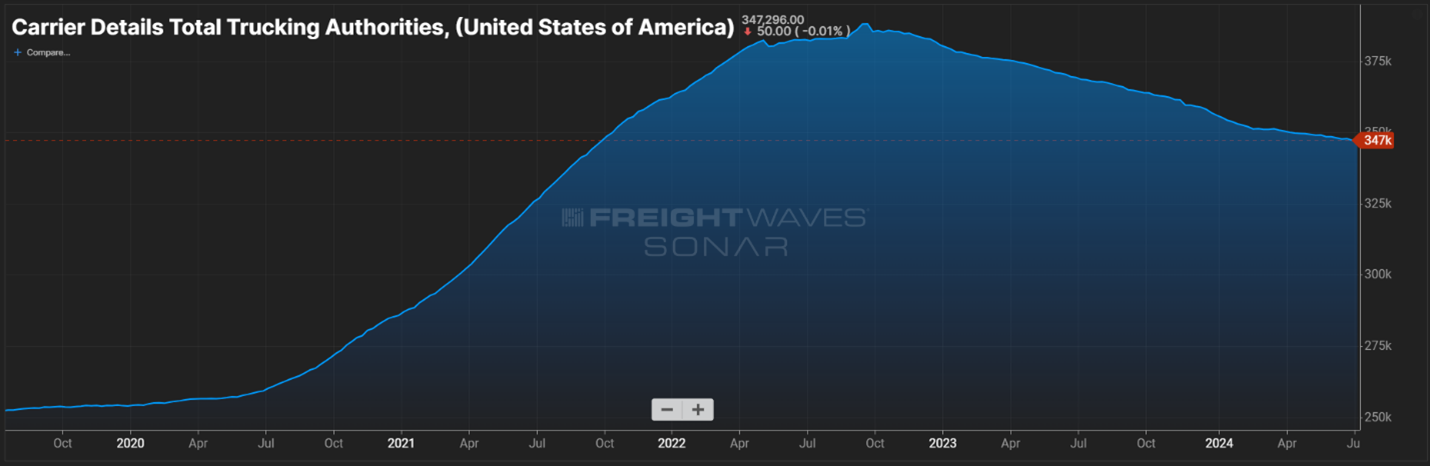

The low rates for dry vans and reefers are not just a result of seasonal fluctuations. They’re also related to the bigger picture of capacity in the market. Even though shipping volumes were at reasonable levels in Q2, rates were still down, which shows how the surge of capacity in 2021 and 2022 is keeping rates lower for longer.

While capacity has declined from its peak in September 2022, there are still about 91,000 more carriers in the TL market than before the pandemic, which is 35.5% more authorities than in March 2020. When there are more carriers competing for loads, rates tend to go down. And we’ve seen this reflected in historically low rates.

However, authorities are down 1.7% since the beginning of the year. Although the rate of carriers exiting the market has slowed, the trend shows that depressed TL rates could be coming to an end.

Source: FreightWaves/SONAR

Factors to watch in Q3

As Q3 unfolds, keep an eye on these trends and events:

Maritime volumes may lead to rate increases

While TL rates remained relatively stagnant in Q2, there may be some changes ahead. Ocean volumes are trending up, which can have a ripple effect on trucking rates. Current data indicates ocean import volumes are 19.3% higher than the same day in 2023.

When international volumes are high, transportation needs at ports are typically impacted 30-45 days later when maritime orders are converted into domestic transportation (road or rail). This means TL rates may ramp up in port lanes as a result.

Fuel prices may be stabilizing

Diesel fuel prices have remained under those of 2023 for most of the quarter, before ticking up in June. Fuel prices have dropped significantly through the beginning of this past quarter. As of the end of 2Q, the U.S. On-Highway Diesel Fuel Price report shows an average price of $3.865/gallon. This means that prices were depressed most of the quarter but rose the last two weeks of June to 1.6% above 2023’s report.

The U.S. Energy Information Administration expects crude oil spot price to be near $89 a barrel for the remainder of 2024 before rising to $91 a barrel in 2025 as global oil production growth picks back up and demand rises. Of course, these predictions are dependent on many geopolitical factors, but it may be time to prepare for a slight increase in fuel prices.

Need a full truckload provider?

At ArcBest, we know the importance of data for shippers and carriers. With insight into the current truckload market, ArcBest is positioned to help you succeed regardless of current trends. With a full suite of transportation solutions for any shipper, including full truckload, contact us today and trust ArcBest with your future freight moves.