What can the manufacturing industry and Industrial Production Index tell us about the freight market?

Last month we discussed the possibility of a recession and why, despite that possibility, there is reason to believe in the long-term health of consumer demand and the logistics industry as a whole. This month we will attempt to provide a better understanding of what a possible recession could look like compared to some historical reference points. This comparison should help explain what is meant by the term “mild” recession and why continued long-term consumer demand is expected.

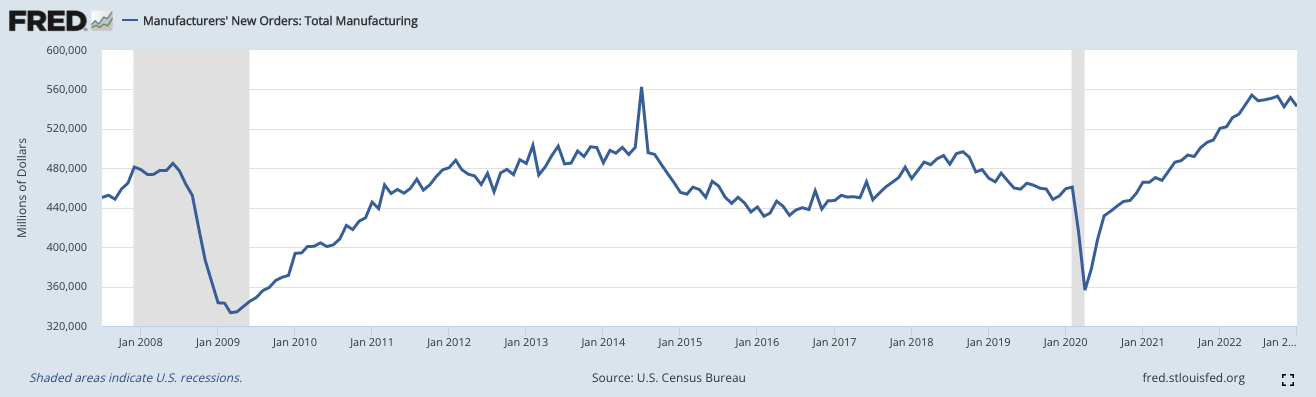

One industry that we watch closely due to its correlation with the logistics industry is manufacturing. Manufacturing also tends to provide a good view of the health of the economy, often seeing considerable declines during recessionary periods. One quick way to get a view of the manufacturing industry is with Manufacturer’s New Orders which can be seen in Figure 1 below.

This graph shows the level of manufacturer’s new orders by month in millions of dollars. The shaded gray area on the left end of the graph is the recession experienced during the 2008 financial crisis. During that period, new orders decreased by over 30% in only 9 months. While a decline in new orders is already being felt in recent months (see the right-hand side of the graph), it is unlikely to be anywhere near the magnitude of the decline experienced 15 years ago.

Figure 1

FRED Graph Manufacturer's New Orders

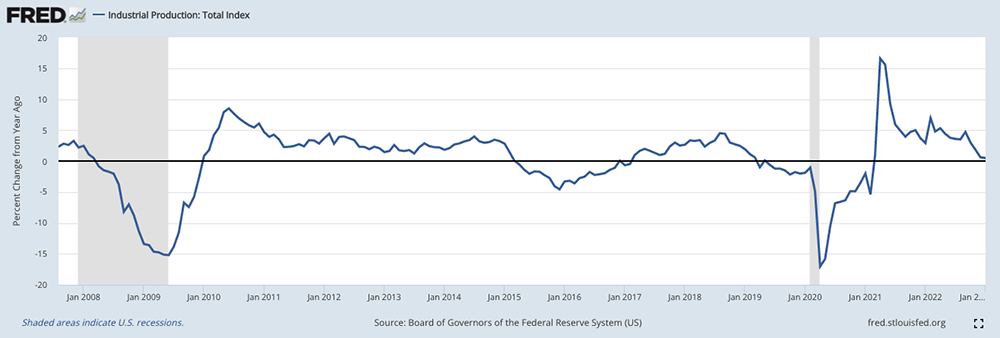

Another metric that we watch is the Industrial Production Index. Like manufacturing, this index tends to experience significant declines during recessionary periods. With industrial production, it’s best to look at a year-over-year perspective.

Figure 2 below displays the Industrial Production Index as a year-over-year percentage going back to 2008. As with manufacturing, you can see the 15% year-over-year decline during the 2008 recession. On the right side of the graph, you can see that we are just now approaching a 0%, or flat, year-over-year level for industrial production. Again, it is possible that we will see a dip into the negative year-over-year territory, but it is unlikely that we will experience a decline as significant as 2008 (or the Covid-caused dip in 2020).

Figure 2

FRED Graph Industrial Production Index

There are many other comparisons that could be made that would display a similar situation. We are clearly experiencing the effects of an economic slowdown as the Fed continues to raise rates in an attempt to do exactly that, in hopes of bringing down the high levels of inflation we have been experiencing for many months. However, when we look at these historical comparisons, it helps put our current environment in perspective with much more significant declines in the recent past.

Once we are past this period of economic weakness, whether it becomes an official recession or not, there is plenty of reason to believe we will return to a growth environment (though nothing is certain). Navigating this period and being prepared for what comes next is going to be crucial in the months ahead.

ArcBest is well-positioned with solutions to fit any need, whatever the future holds. As a logistics company with owned assets, advanced supply chain technology, and an experienced customer solutions team, we’re able to help shippers solve even the toughest logistics challenges.